Make your next move with confidence

We know life brings changes. You'll need Medicare coverage you can count on for your whole life ahead.

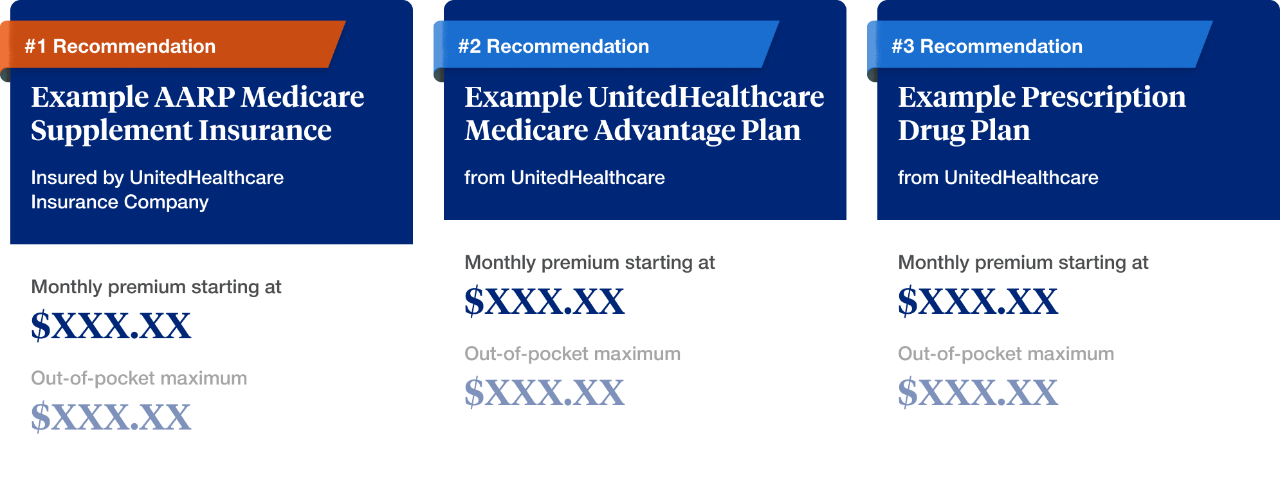

Get a Medicare plan recommendation

You've got plans, big and small. Let's pick a Medicare plan with confidence. Answer a few simple questions about your preferences and find the right UnitedHealthcare plan for you.

UnitedHealthcare Medicare coverage for whatever's next

Medicare Advantage (Part C) plans offer all the benefits of Original Medicare (Part A and Part B), with extras like dental, vision, hearing, and prescription drug coverage.

Chronic Special Needs plans (C-SNPs) are designed for people living with qualifying chronic conditions.

Medicare Supplement (Medigap) plans help pay some of the out-of-pocket costs that Original Medicare doesn't pay.

Medicare Part D prescription drug plans help pay for prescription drugs. You can combine a Part D plan with Original Medicare or a Medicare Supplement (Medigap) plan.

Dual Special Needs plans (D-SNPs) are Part C plans designed for people who are eligible for both Medicare and Medicaid coverage. Many include extra benefits.

Stay up-to-date with what's changing with Medicare in 2026

You can count on UnitedHealthcare for the latest industry updates that could impact your Medicare plan.

We're here to help you through these changes with expert guidance every step of the way.

Learn more about Medicare

Get easy-to-understand guidance today and as your needs change.

Medicare insurance plans as reliable as you

At UnitedHealthcare, there’s a plan for all your plans. More people choose UnitedHealthcare for their Medicare coverage than any other company, making us the #1 provider of Medicare plans in the nation.3

9 out of 10 members are able to keep their preferred doctors when choosing a UnitedHealthcare Medicare Advantage plan4

You've got questions.

We've got answers.

Chat with UnitedHealthcare

Chat is currently unavailable.

Please try again later.

Important Information

Medicare Supplement insurance plans include guaranteed coverage for life, as long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this Plan.

1 The rates provided here only apply for the effective date requested and are based on the information you previously entered. Your actual rate will be determined upon acceptance and based on answers to the questions on your application form. All rates are subject to change. Any rate change will apply to all members of the same class insured under your plan who reside in your state/area. These rates are not for current insured members. If you are already an insured member, please call for information.

2 These offers are available at no additional cost to you and are only available to insured members covered under an AARP Medicare Supplement Plan from UnitedHealthcare Insurance Company. These are additional insured member services apart from the AARP Medicare Supplement Plan benefits, are NOT INSURANCE PROGRAMS, are subject to geographical availability and may be discontinued at any time. Certain offerings are provided by third parties not affiliated with UnitedHealthcare Insurance Company. None of these services are a substitute for the advice of a doctor or should be used for emergency or urgent care needs. In an emergency, call 911 or go to the nearest emergency room.

3 From a report prepared for UnitedHealthcare by Human8, “Substantiation of Advertising Claims concerning AARP Medicare Supplement Insurance Plans and UnitedHealthcare Medicare Advantage Plans (Non-SNP, D-SNP, and C-SNP)” August 2025, www.uhcmedsupstats.com or call 1-800-272-2146 to request a copy of the full report.

4 Member responses based on Human8 survey, May 2025. Most chosen based on total plan enrollment from 2008-2025 Medicare Enrollment Data.

5 Select Plan G offers the same standard benefits as Plan G, except you must use a network hospital for covered Inpatient Hospital services under Medicare Part A. You should also verify that your chosen physician is affiliated with a network hospital.

6 Select Plan N offers the same standard benefits as Plan N, except you must use a network hospital for covered Inpatient Hospital services under Medicare Part A. You should also verify that your chosen physician is affiliated with a network hospital.

7 Plan N pays 100% of the Part B coinsurance, except for a co-payment of up to $20 for some office visits and up to a $50 co-payment for emergency room visits that do not result in an inpatient admission.

8 Plan K pays 100% of covered services for the rest of the calendar year once you meet the out of pocket yearly limit. You will pay half of the cost-sharing of some covered services until you reach the annual out of pocket limit of $8,000 each calendar year. Once you reach the annual limit, the plan pays 100% of the Medicare co-payment and co-insurance for the rest of the calendar year. However, this limit does NOT include charges from your provider that exceed Medicare approved amounts (these are called "Excess Charges") and you will be responsible for paying this difference in the amount charged by your provider and the amount paid by Medicare for the item or service.

9 Plan L pays 100% of covered services for the rest of the calendar year once you meet the out of pocket yearly limit. You will pay one-fourth of the cost-sharing of some covered services until you reach the annual out of pocket limit of $4,000 each calendar year. Once you reach the annual limit, the plan pays 100% of the Medicare co-payment and co-insurance for the rest of the calendar year. However, this limit does NOT include charges from your provider that exceed Medicare approved amounts (these are called "Excess Charges") and you will be responsible for paying this difference in the amount charged by your provider and the amount paid by Medicare for the item or service.

10 This high deductible plan pays the same benefits as Plan G after you have paid a calendar year $2,950 deductible. Benefits from the high deductible Plan G will not begin until out-of-pocket expenses are $2,950. Out-of-pocket expenses for this deductible include expenses for the Medicare Part B deductible, and expenses that would ordinarily be paid by the policy. This does not include the plan's separate foreign travel emergency deductible.

View Important Disclosures Below

Every year, Medicare evaluates Medicare Advantage plans based on a 5 Star rating system. The 4+ Star rating applies to plan year 2026. Star ratings may vary by plan/area. #1/More in members based on total plan enrollment in 4, 4.5 or 5 Star plans from 2017-2026 Medicare Enrollment Data.

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Plans insured by UnitedHealthcare Insurance Company, 185 Asylum Street, Hartford, CT 06103 (available in all states/territories except ND, NY) or UnitedHealthcare Insurance Company of America, 1600 McConnor Parkway, Floor 2, Schaumburg, IL 60173 (available in AR, AZ, IL, IN, KS, MS, NC, ND, NJ, OH, OK, PA, SC, TN). Policy Form No. GRP 79171 GPS-1 (G-36000-4).

Please note: You must be an AARP member to enroll in an AARP Medicare Supplement Insurance plan. If you are not a member, you can join AARP for just $20.00 a year.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

Not connected with or endorsed by the U.S. Government or the federal Medicare program.

This is a solicitation of insurance. A licensed insurance agent/producer may contact you.

THESE PLANS HAVE ELIGIBILITY REQUIREMENTS, EXCLUSIONS AND LIMITATIONS. FOR COSTS AND COMPLETE DETAILS (INCLUDING OUTLINES OF COVERAGE), CALL A LICENSED INSURANCE AGENT/PRODUCER AT THE TOLL-FREE NUMBER ABOVE.

Medicare Advantage plans and Medicare Prescription Drug plans

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare. You do not need to be an AARP member to enroll in a Medicare Advantage plan or Medicare Prescription Drug plan.

This information is not a complete description of benefits. Contact the plan for more information.

WB28059ST (06-25)